From China’s mobile revolution to the untapped potential of India’s 1.2 billion consumers, Alex Brownsell explores Asia Pacific’s exciting and dynamic media landscape.

“Mobile, mobile, mobile.” To succinctly describe the expansive marketing and media landscape in a region as vast, populous and varied as Asia Pacific is no easy feat, but Unilever regional vice-president for media Rahul Welde’s mantra sums it up fairly well.

APAC is the mobile-first continent, where many hundreds of thousands of people are being exposed to the internet not through desktop, but via mobile handsets. Some go even further, arguing that parts of Asia ought to be considered “mobile only”. Either way, this part of the world poses a unique challenge for brands and publishers.

According to Welde – chair of the judges at the Festival of Media Asia Pacific Awards 2016 – the “explosion” of mobile as the primary media device is powering all other trends in APAC, including the fast-rising consumption of online video and the increased use of multi-format, multi-platform content as a communications tool.

And though mobile spend remains relatively low when set against consumer behaviour patterns in many parts of Asia, it now occupies “centre stage” for marketers trying to reach new audiences, says Welde.

Chinese bellwether

In the search for something akin to a bellwether for the wider region, it is impossible to look beyond China, the engine of global advertising spend growth over the past decade.

The slowdown in the Chinese economy – its 2015 growth rate of under 7% was the slowest for a quarter of a century – has caused advertisers headaches, but the media spend picture offers continued reason for optimism.

Graham Christie, chief executive of Big Mobile Group, an APAC-based mobile marketing consultancy, claims the impact of China’s slowdown on media has, in fact, been negligible.

“We don’t see a hit on confidence or activity in China, such is the economic growth and urbanisation and resulting appetite for brand,” he says.

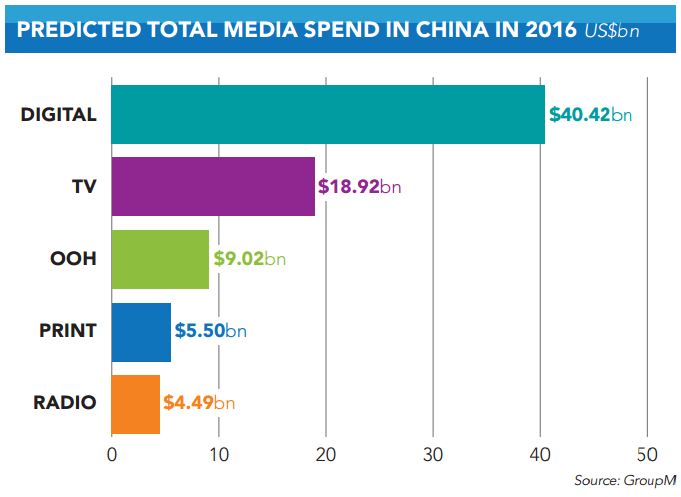

The numbers look good. Digital ad spend is expected to reach $40.2bn in 2016, according to recent data from eMarketer, up 30% year-on-year – and the research company expects that figure to more than double to $83.6bn by 2020. That compares with the far-smaller figures to be spent this year on TV ($18.9bn), out of home ($9bn) and print ($5.5bn).

“Between them, Baidu, WeChat-owner Tencent and Alibaba are expected to hoover up 73% of China’s mobile ad market this year”

The growth in mobile media spend is set to grow even faster, as advertisers look to target those operating the country’s estimated 900 million-plus smartphones. Of the $40.4bn spend on digital media in China in 2016, eMarketer believes more than two-thirds (67%) will go on mobile channels; fast-forward to 2020 and that figure rises to 84%.

That surge in mobile spend is partly down to the remarkable appetite of Chinese consumers for video. The eMarketer study predicts that, within four years, 15% of all media spend in China will go towards digital video – and three-quarters of that specifically mobile video.

However, where China significantly differs from other markets in the region is in the dominance of a trio of domestic tech champions. Between them, Baidu, WeChat-owner Tencent and Alibaba are expected to hoover up 73% of China’s mobile ad market this year, a dominance that Big Mobile’s Christie says should be considered a positive – offering “scale” and “stability” for marketers.

Hungry for innovation

The contrast with a mature, Western market such as Australia is stark. Growth in this market is far lower, and Morgan Stanley estimates that a small number of mainly US digital media firms – Google, Facebook, Twitter – already occupy up to 40% of the overall ad market, a trend which is only set to continue.

For Robbert Rietbroek, chief executive of PepsiCo Australia and New Zealand, the task for global advertisers in that part of APAC is to deliver new experiences for consumers who have “very high” brand and product loyalty, but who are “hungry for innovation” and are quick to adopt new technologies.

“The Australian industry continues to be strong, and brand investments continue to be high,” says Rietbroek. “[But] we do see a general shift in mix away from traditional advertising into more and more content-based digital brand building, which continues to deliver higher ROI year on year.”

Australian consumers are becoming more likely to purchase on mobile, meaning that advertisers must invest or face losing out on sales in the e-commerce battle, argues Rietbroek.

“Most online visits, as much as two-thirds depending on category and industry, today happen via mobile devices,” he says. “All digital branded content therefore has to be mobile-ready, and brands need to invest in the right digital assets in order to enable frictionless interactions.”

That hunger for innovation does not stop with Australia’s consumers; its brands are also keen to push the envelope, particularly when it comes to marketing automation. The Boston Consulting Group has gone so far as to describe the market as “leading the world” when it comes to the programmatic buying and selling of media, with an estimated $724m spent programmatically in 2015, up 25% on the previous 12 months.

It goes beyond display ads, too, with mobile and video media also quickly moving over to automated methods, and a significant number of test projects exploring how offline media such as television and OOH could be automated and bought programmatically.

Untapped potential

If Australia, along with markets such as Japan and Korea, offers a snapshot of mature APAC, then at the other end of the spectrum lies the immense, largely untapped potential of India.

With concerns remaining over China’s ability to return to its breakneck growth of old, eyes are turning to India, with its population of 1.25 billion people – the vast majority of whom remain cut off from the online world.

GroupM believes that ad spend in India will increase by 15.5% in 2016, up from the previous year’s rate of 14.2%, making it the fastest-growing of all “key” global markets. This will be driven by sectors such as FMCG, automotive and e-commerce, which are expected to contribute 28%, 8.2% and 8.1% respectively to India’s overall ad spend total.

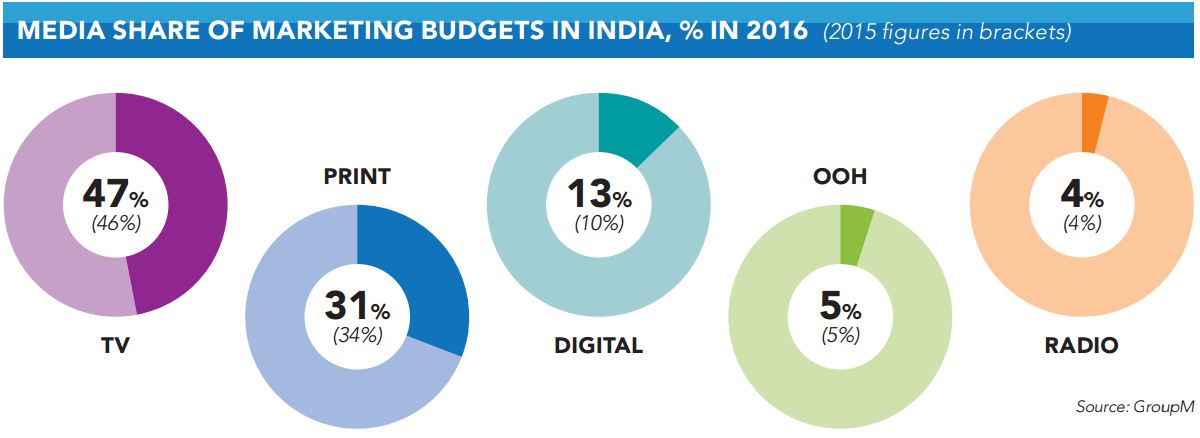

However, the media mix looks very different from much of the rest of Asia. TV remains by far and away India’s biggest media channel, and is still growing fast, with GroupM predicting an increase of 17.6% this year. Even the newspaper industry, buffeted in the winds of digitisation everywhere else in the world, can look forward to 6% year-on-year growth, according to the study.

Digital media is growing fast, of course, with an increase of 47.5% anticipated in 2016, but it is from a far lower base. For all the excitement around the mobile-centric nature of India’s online community, Pew Research Center figures suggest as few as 17% of Indians own a smartphone, compared with 21% of Indonesians and 65% of Malaysians.

The lack of infrastructure, crowded mobile ecosystem and general volatility make it a daunting market for Western brands and media companies – see the bloody nose dished out to otherwise-mighty Facebook over its effectively banned Free Basics product promising to connect users with a small selection of websites.

Yet the potential rewards are huge. For this reason alone, argues Steve Kalifowitz, head of brand strategy and advocacy, APAC and MENA, at Twitter, we should all be excited about India. “A billion people there still haven’t even accessed the internet yet – the potential is incredible,” says Kalifowitz. “India is an amazing country and, certainly for Twitter, it’s one of our top markets in the world in terms of access and growth.

“One need only look at the leaders of Google and Microsoft to spot the rising importance of India from a talent perspective”

“We have incredible engagement from heads of state like prime minister Narendra Modi using Twitter in a sophisticated way. It runs through a gamut of society: actor Shah Rukh Khan, actress Deepika Padukone, cricketer Virat Kohli,” he says.

As well as a strong desire for social media from the nation’s celebrities, and spikes of engagement during sporting events such as the recent World T20 cricket tournament hosted in India, Kalifowitz also sees innovation from brands. He describes a recent campaign by Audi and its agency Wieden + Kennedy, which saw the VW-owned marque feature live tweets in a TV ad – something heretofore only attempted in Western markets.

And one need only look at the leaders of Google and Microsoft – Sundar Pichai and Satya Nadella were both born in India – to spot the rising importance of India to brands, agencies and media owners from a talent perspective.

Not all straightforward

For all its promise, not everything is straightforward for advertisers in APAC. Compared with any other major business region, it is highly divided along linguistic, cultural and technological lines.

As Starcom MediaVest Group’s president of global network client, APAC, Ken Mandel points out, one content size “does not fit all” for Asia’s consumers. Brand content producers must go to extra editorial effort to ensure all output matches the needs of diverse local markets. They should also consider the varying broadband capabilities in each territory, particularly when it comes to video.

And concerns around internet speeds may see the arrival of one of North America and Europe’s most-feared scourges: ad blocking. As Mandel observes: “APAC seems to have lower ad blocking usage than other regions. But this may change as consumers realise that other benefits of ad blocking are not the ads per se, but improving the speed of their content consumption and reducing their mobile data usage.”

The scarcity of high-quality, comparable consumer data and measurement tools across markets in Asia, especially in parts of South East Asia, often forces advertisers towards media owners such as Facebook and Google. In China, WPP’s GroupM, Dentsu Aegis Network and Omnicom Media Group have each forged agreements to access Tencent’s trove of data in order to better target local audiences.

InSkin Asia general manager Angeline Lodhia says there is “a thirst” for more data and knowledge to demonstrate ROI for clients across direct response and digital branding campaigns.

Viewability is also rising up the agenda in APAC, according to Lodhia. “We’ve been speaking to clients and agencies about viewability metrics and everyone agrees that more understanding and adoption are important to develop the digital ecosystem. Accurate use of data for learning remains at the core of objectives for all, and the coming months will be an interesting development time in Asia as the market continues to shape,” she says.

However, the above concerns aside, those operating in this part of the world will also most likely find themselves at the cutting edge of technological developments in areas such as virtual reality (VR).

February’s Mobile World Congress in Barcelona featured the introduction of a host of new VR systems, notably from Asian brands such as Samsung, HTC and Sony. Chris Stephenson, regional head of strategy, APAC, at Omnicom Media Group agency PHD, believes brands should begin investigating its potential today.

“A lot of the businesses and brands that are driving this are at the heart of the APAC economy,” he says. “All brands should absolutely be exploring how they can use this technology and how they can scale it.”

Beyond VR, Stephenson believes the most important media and marketing trend to watch over the coming years is artificial intelligence (AI). The development of advanced algorithmic software systems is a hot topic in Asia at the moment, following the defeat inflicted by Google’s AlphaGo programme over Korea’s world top-three player Lee Sedol at highly complex board game Go.

More so than even Deep Blue’s victory over chess champion Garry Kasparov 20 years ago, this is being billed as a significant moment in the development of AI.

“A lot of markets in APAC are very rampant adopters of new technology, particularly smartphones”

“It wasn’t just that [AlphaGo] won,” says Stephenson. “It’s the fact it won in a way that those familiar with the game described as an elegant and creative playing style. You could see the algorithm learning – not just getting better, but developing strategies.”

DeepMind, the company behind AlphaGo, is actually British, and was acquired by Google in 2014. However, Stephenson argues that AI will make a quicker impact in APAC, given the “rampant” adoption of new tech by consumers in the region.

He cites virtual personal assistants (VPAs) as one of the major AI opportunities for brands, and claims that within the next two years the industry will begin to use programmatic infrastructure to target consumers based not on market segmentation, but rather on intention.

“A lot of markets in APAC are very rampant adopters of new technology, particularly smartphones. Australians are disproportionate users of social; the Chinese are disproportionate users of online video. Other Asian markets such as Japan and Korea are incredibly disproportionate adopters of mobile,” he says.

“I fully expect APAC to be front and centre of that change [towards AI], given what we already know about consumer behaviour in the region,” Stephenson adds.

As stated at the beginning of this feature, it is nigh-on impossible to summarise the marketing and media landscape in APAC in 2,000 words, let alone in a solitary sentence.

The mobile mantra of Unilever’s Welde at least informs advertisers of the direction in which they ought to focus their efforts. And Welde also encapsulates the excitement of operating in this most vibrant part of the world: “Marketing will continue to be very exciting and dynamic. The next few years will be the best years for anyone in marketing.”