If brands wish maximise advertising ROI, the key is to identify the loyal app users whose long-term value will exceed the initial acquisition investment, writes Hannu Verkasalo, chief executive of Verto Analytics.

The importance of mobile is a foregone conclusion for most brands and advertisers: according to eMarketer, almost 50% of total digital time spent takes place on mobile devices, and mobile ad spend will exceed more than 50 percent of all digital ad spend by the end of 2016.

And with Google on the verge of splitting its eponymous search index into two distinct versions – a “rapidly updated mobile” one, and a “separate, secondary search index for the desktop web”, a mobile-first advertising and optimisation philosophy is rapidly becoming a business imperative, not a “nice to have.”

Almost every conversation about mobile invariably leads to apps, and the KPIs and metrics that brands, advertisers, ad networks and app publishers rely on in order to measure the performance of a given app or benchmark it against competitors. This is where we need to start seriously looking beyond the download as the ultimate indicator of an app’s monetisation value and what opportunities it could offer to advertisers, agencies and brands.

Downloads don’t always correlate with actual usage

The success of an app is typically measured by the number of users who download the app. While downloads can be an initial measure of app success, the rate at which users disappear over time points to the fact that measuring long-term value is more important.

For example, while Pokémon GO was the surprise hit mobile game of the summer, attracting 45 million downloads and more than 30 million users per day, its numbers look far different four months after its initial release. By the end of October, Verto data shows that the game’s daily user numbers were hovering closer to five million.

“Ultimately, we need to move away from the number download as an indicator of success and instead focus on usage-related metrics”

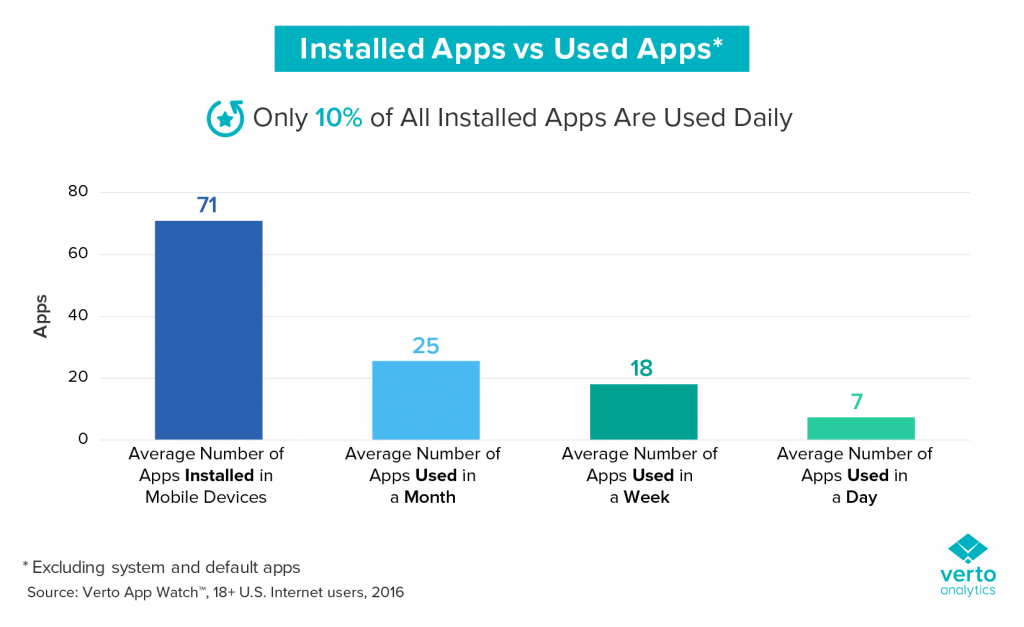

So, while downloads do result in a certain installed base of apps on a device, that metric does not necessarily correlate with actual usage. Consumers download and install hundreds of apps, but Verto Analytics data shows that the average user only uses 18 apps on a weekly basis, while only seven apps are actively used daily.

To make things even more challenging, the typical app retains only 5% to 20% of users after 30 days. That means that one million app downloads equates to only 50,000 to 200,000 users after the first 30 days.

Creating a better model

When it comes to looking beyond sheer download numbers, app companies, advertisers and brands need to consider the following:

– Mobile app install advertising drives more than 50% of the mobile advertising market.

– The industry needs a new framework for measuring mobile app advertising ROI, based on measuring the conversion from installs to long-term user activity.

– Only about 0.5% to 2% of all downloads lead to long-term monetisable users – optimise for this audience segment.

Ultimately, we need to move away from the number download as an indicator of success and instead focus on usage-related metrics (the time a user spends engaged with a given app, frequency, and other session data) and user retention rates.

This framework, which we call the Verto Retention Report, reveals the core group of users that remain 30 days post-download. Most importantly for brands and advertisers, these so-called loyal active users are also the ones that can be monetised.

The challenge ahead

If brands, advertisers and app publishers want to maximise advertising ROI, the key is to identify the loyal users whose long-term value will exceed the initial acquisition investment. Doing so requires ongoing measurement of the size, structure, quality and profile of the app audience and benchmarking performance against competitors in the same industry.

Only then can the industry move past the reigning standard of downloads as measure of success.